Visa

LTR Visa Update 2025: Key Changes and Benefits Explained

On January the 14th, Thailand’s Cabinet approved relaxed conditions for approving long-term resident (LTR) visas aimed at attracting wealthy individuals and high-income individuals to Thailand.

The Cabinet approved a proposal from the Office of the Board of Investment (BOI) to simplify LTR visa requirements while also removing Smart visa categories, which were deemed too similar to the LTR visas and created unnecessary confusion.

The changes for the LTR visa update targets three groups: individuals working remotely from Thailand, wealthy global citizens, and dependents of LTR visa holders.

Key points

- Thailand’s Cabinet approved reduced Long-Term Resident (LTR) visa requirements, reducing company revenue requirements from $150M to $50M for Work-from-Thailand Professionals and removing the $80,000 annual income requirement for Wealthy Global Citizens.

- The government will eliminate most SMART visa categories (except SMART visa S for startups) to reduce overlap with LTR visas.

- Work-from-Thailand Professionals and Wealthy Global Citizens receive tax benefits including exemption on foreign-sourced income, while Highly-Skilled Professionals qualify for a 17% flat tax rate.

- The new proposal also removed previous restrictions on the number of dependents (formerly capped at 4) who can be included under an LTR visa holder’s application.

What is the LTR Visa in Thailand?

The LTR (Long-Term Resident) Visa was introduced by the Thai government to promote the economy and attract foreign investment. This visa aims to encourage domestic spending, support business growth, and create income-generating opportunities for individuals residing in Thailand.

By introducing the LTR, the Government hopes to create a welcoming environment for foreign residents and investors, to encourage them to contribute to Thailand’s economic development.

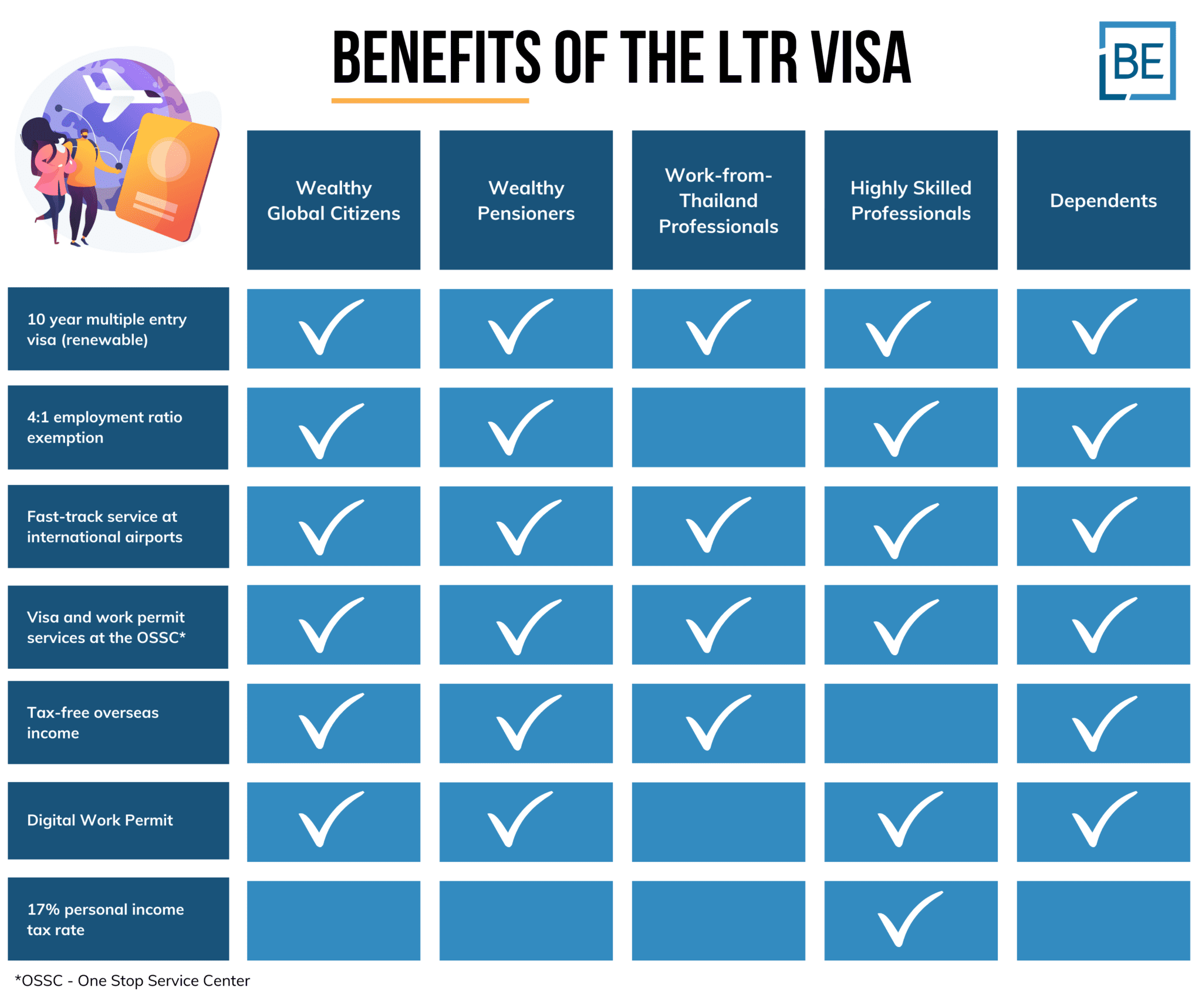

The LTR Visa in Thailand is available to four categories of applicants:

- Wealthy Global Citizens

- Wealthy Pensioners

- Work-from-Thailand Professionals

- Highly Skilled Professionals

Additionally, the visa extends to the spouses and dependents of LTR Visa holders, ensuring families can also benefit from this program.

For more information about the LTR visa, the application requirements/criteria, how to apply for the LTR and how it could be beneficial to you, please see the following articles from our blog:

Thailand Long-Term Resident (LTR) Visa: A Guide to Tax Benefits and Eligibility

What is the New LTR Visa Update?

Thailand’s Cabinet has approved the following changes to the LTR and SMART visa programs in Thailand.

Work From Thailand Professionals

The LTR Visa for Work-from-Thailand Professionals is designed to attract remote workers employed by well-established overseas companies to live and work in Thailand. This visa removes the need for traditional visas and work permits typically required for employment in Thailand.

Previously, one of the most important criteria for qualification was the requirement for the foreign employees company to, be a public company (listed on a stock exchange outside Thailand), or a private company that has been operating abroad for at least 3 years and have earned a revenue of not less than $150 million over the past consecutive 3 years.

However, the requirement for the company to have a revenue of over $150 million over the past 3 years has proven to be a stumbling block for applicants. As a result, the Cabinet agreed with the BOI’s proposal to lower the income requirement from US$150 million to US$50 million in annual revenue over three years.

Wealthy Global Citizens

Thailand’s Long-Term Resident (LTR) Visa for Wealthy Global Citizens is designed to attract high-net-worth individuals. This LTR category targets financially independent individuals with significant assets and stable incomes.

By welcoming wealthy global citizens, Thailand aims to stimulate economic growth through luxury property investments, high-value spending, and contributions to the local economy.

Under the new proposal from the BOI, the requirement for LTR visa applicants to have an annual income of at least US$80,000 for two consecutive years before applying for the visa will be removed.

The reason for the removal of this is because the BOI found that some applicants who met all the other relevant investment criteria were denied the visa because they failed to meet the US$80,000 annual income requirement.

The LTR Visa for Dependents

The Cabinet has approved the removal of restrictions on the number of dependents eligible under the Long-Term Resident (LTR) Visa program. Previously, the program limited the number of dependents to four, unlike other visa types that imposed no such cap.

Updates to the SMART Visa Program

The proposal to remove most Smart visa categories, retaining only the Smart visa S for startup business owners was also approved. The BOI believe that the conditions for the other Smart visa categories closely resemble those of the LTR visa. As a result, the LTR visa will now be promoted as the primary option for attracting wealthy global citizens to Thailand.

The SMART Visa S, is a category specifically designed to attract individuals with expertise in specific targeted industries, including professionals, investors, and entrepreneurs to enhance Thailand’s competitiveness in technology, medical services, and more sectors.

SMART Visa S is available in three categories:

Smart Visa S (1) – Experts: This category is for highly skilled professionals and experts in specific industries, such as technology, medical services, and more.

Smart Visa S (2) – Investors: This category is for investors who make significant financial contributions to qualifying businesses in Thailand.

Smart Visa S (3) – Startup Entrepreneurs: This category is for individuals looking to establish startup companies in Thailand.

Holders of the SMART Visa S are exempt from obtaining a work permit and are eligible for various benefits, such as longer stays, work flexibility, and family inclusion.

For more information, please see the following blog:

What are the Key Benefits of the LTR Visa?

The LTR Visa offers a range of privileges to holders, making living and working in Thailand more convenient and advantageous including:

10 Year Visa

LTR Visa holders are granted a 10-year visa permission to stay in Thailand. The initial visa is valid for five years and can be extended for an additional five years if the qualifying criteria are met.

Exemption from Employment Requirement Ratio

LTR Visa holders are exempt from the requirement of having four Thai employees for every foreign employee (4:1). This exemption provides flexibility for businesses and encourages foreign investment.

Setting up a company in Thailand would be an attractive option for holders of an LTR who applied under the ‘Work From Thailand’ or ‘Highly Skilled Professionals’ options.

One of the drawbacks to forming a traditional company structure (Private Limited Company) in Thailand is the restrictions on hiring foreign staff. Typically, you must hire 4 Thai employees for each foreign staff member. This quota does not apply to LTR visa holders.

Fast-Track Service at International Airports

LTR Visa holders can enjoy fast-track service at international airports in Thailand, ensuring a smooth and efficient entry and exit process. Fast-Track services are available at the following airports in Thailand:

- Chiang Mai – Chiang Mai International Airport (CNX)

- Koh Samui – Samui International Airport (USM)

- Krabi – Krabi International Airport (KBV)

- Phuket – Phuket International Airport (HKT)

- Bangkok – Suvarnabhumi Airport (BKK)

1 Year Report of Residence and Re-entry Permit Exemption

Most visa holders in Thailand must submit a notification of their place of residence to the Thai Immigration Office every 90 days. This is not required for holders of the LTR who only need to do this report once per year.

Additionally, they are exempt from the requirement of obtaining a re-entry permit.

Read more:

Permission to Work in Thailand

LTR Visa holders are granted permission to work in Thailand. Holders of the LTR and their dependents will be eligible to receive a Digital Work Permit.

Applicants must secure employment in Thailand before applying for the Digital Work Permit.

Immigration and Work Permit Facilitation Services

LTR Visa holders can access immigration and work permit facilitation services at the One Stop Service Center for Visa and Work Permit. This streamlines the process and reduces administrative burdens. This is a significant advantage when compared to other visa types (excluding BOI visas) who have to deal with local immigration offices, extensive document checks and long wait periods for the approval of the visa and/or extension.

What are the Tax Benefits for Long-Term Resident Visa Holders?

One of the key advantages of the LTR Visa program is the range of tax benefits it offers eligible individuals.

Highly-Skilled Professionals: 17% Flat Tax Rate

Highly-Skilled Professionals with the LTR Visa are entitled to a discounted personal income tax rate of 17%. This is a significant advantage, considering Thailand’s regular personal income tax rates range from 5% to 35%. To qualify for this special tax rate, the following conditions must be met:

- The individual must be an expert in targeted industries, working for business entities, higher education institutes, research centres, specialised training institutions in Thailand, or Thai government agencies.

- Earn assessable income under Section 40 (1) of the Revenue Code while performing duties for a company that satisfies the above criteria.

- File a personal income tax return (P.N.D. 95) for a tax year as required by the law;

- The employer can agree with the professional to withhold tax at a flat rate of 17%.

- If the foreign employee has been subject to withholding tax at a flat rate of 17%, they are exempt from including the income in their personal income tax return, provided they do not request a refund or credit for the tax paid.

- In cases where the foreigner has received assessable income subject to withholding tax under specific sections of the Revenue Code, they can treat the tax withheld as final tax and exclude the income from their personal income tax return.

If an employee fails to adhere to the rules, procedures, and conditions in any given tax year, they will not be eligible for income tax exemption in that specific tax year.

Read more:

Foreign Sourced Income Tax Exemption

Wealthy Global Citizens, Wealthy Pensioners, and Work-from-Thailand Professionals LTR Visa holders are entitled to an income tax exemption for income derived from:

- business conducted abroad or

- assets located abroad that have been remitted into Thailand.

It’s important to note that the tax concessions provided by the LTR Visa program are subject to rules and conditions prescribed by the Revenue Department. This is an important benefit due to the new rules implemented in 2024 relating to the remittance of foreign income to Thailand.

Please note that this exemption does not apply to Highly Skilled Professional LTR holders.

How can Belaws help?

For more information about the LTR visa in Thailand why not talk to one of our experts now?

Please note that this article is for information purposes only and does not constitute legal advice.

Our consultations last for a period of up to 1 hour and are conducted by expert Lawyers who are fluent in English, French and Thai.

Consultations can be hosted via WhatsApp or Video Conferencing software for your convenience. A consultation with one of our legal experts is undoubtedly the best way to get all the information you need and answer any questions you may have about your new business or project.

USD 150

Up to 1 hour

Online payment (Paypal or Credit card)

Legal consultation can be conducted in English, French or Thai

Legal consultations are handled by experienced lawyers from the relevant fields of practice

Frequently asked questions

What is the LTR Visa in Thailand?

The Long-Term Resident (LTR) Visa is a program introduced by the Thai government to attract foreign investment and promote economic growth. It offers long-term residency and various benefits for four categories of applicants:

- Wealthy Global Citizens

- Wealthy Pensioners

- Work-from-Thailand Professionals

- Highly Skilled Professionals

It also extends to spouses and dependents of LTR Visa holders.

What are the key updates to the LTR Visa in 2025?

On January 14, 2025, Thailand’s Cabinet approved relaxed conditions for LTR visas:

- Reduced company revenue requirement for Work-from-Thailand Professionals from $150M to $50M.

- Removal of the $80,000 annual income requirement for Wealthy Global Citizens.

- Removal of restrictions on the number of dependents included in an application.

- Elimination of most SMART visa categories (except SMART Visa S for startups).

What are the benefits of the LTR Visa?

LTR Visa holders enjoy several advantages, including:

- A 10-year visa (initially five years, extendable for another five years).

- Exemption from the 4:1 Thai-to-foreign employee ratio requirement.

- Fast-track service at international airports in Thailand.

- Annual residence reporting instead of the standard 90-day reporting.

- Exemption from re-entry permit requirements.

- Permission to work in Thailand with a Digital Work Permit.

- Access to immigration and work permit facilitation services at the One Stop Service Center.

What tax benefits are available for LTR Visa holders?

- Highly-Skilled Professionals qualify for a flat 17% personal income tax rate.

- Wealthy Global Citizens, Wealthy Pensioners, and Work-from-Thailand Professionals are exempt from taxes on foreign-sourced income remitted into Thailand.

How does the updated LTR Visa impact Work-from-Thailand Professionals?

The revenue requirement for employers has been reduced from $150M to $50M over three years, making it easier for remote workers employed by international companies to qualify.

How does the update benefit Wealthy Global Citizens?

The removal of the $80,000 annual income requirement allows more high-net-worth individuals to qualify, as long as they meet the investment and financial stability criteria.

What changes were made to the LTR Visa for dependents?

Previously, there was a cap of four dependents per LTR Visa holder. This restriction has been lifted, allowing more family members to be included in the application.

What updates were made to the SMART Visa program?

Most SMART visa categories have been eliminated, except for SMART Visa S, which is designated for startup founders, investors, and experts in targeted industries. This change reduces redundancy and aligns Thailand’s immigration programs with its economic goals.

Where can I find more details on the LTR Visa and its application process?

For more information, refer to:

- Thailand LTR Visa

- Thailand Long-Term Resident (LTR) Visa: A Guide to Tax Benefits and Eligibility

- Long-Term Resident (LTR) Visa Benefits

- The SMART Visa S – Everything You Need to Know

Related articles

Subscribe today

Subscribe today

To our newsletter for all the latest legal news

in South East Asia, Belaws updates and

special promotions on our services.

To our newsletter today for all the latest legal news in South East Asia,

Belaws updates and special promotions on our services.