Belaws Home ›› Thailand ›› Blog ›› Thailand Tax Incentives for Foreign Investors from the BOI

Tax

Thailand Tax Incentives for Foreign Investors from the BOI

14/08/2024

The Board of Investment (BOI) plays a major role in attracting foreign investment and boosting economic growth in Thailand. As a government agency, it has a significant impact on shaping Thailand’s investment landscape by offering a range of incentives to both local and international investors. These incentives aim to enhance Thailand’s competitiveness and to create a favourable environment for businesses to thrive in various sectors especially in relation to Thailand tax.

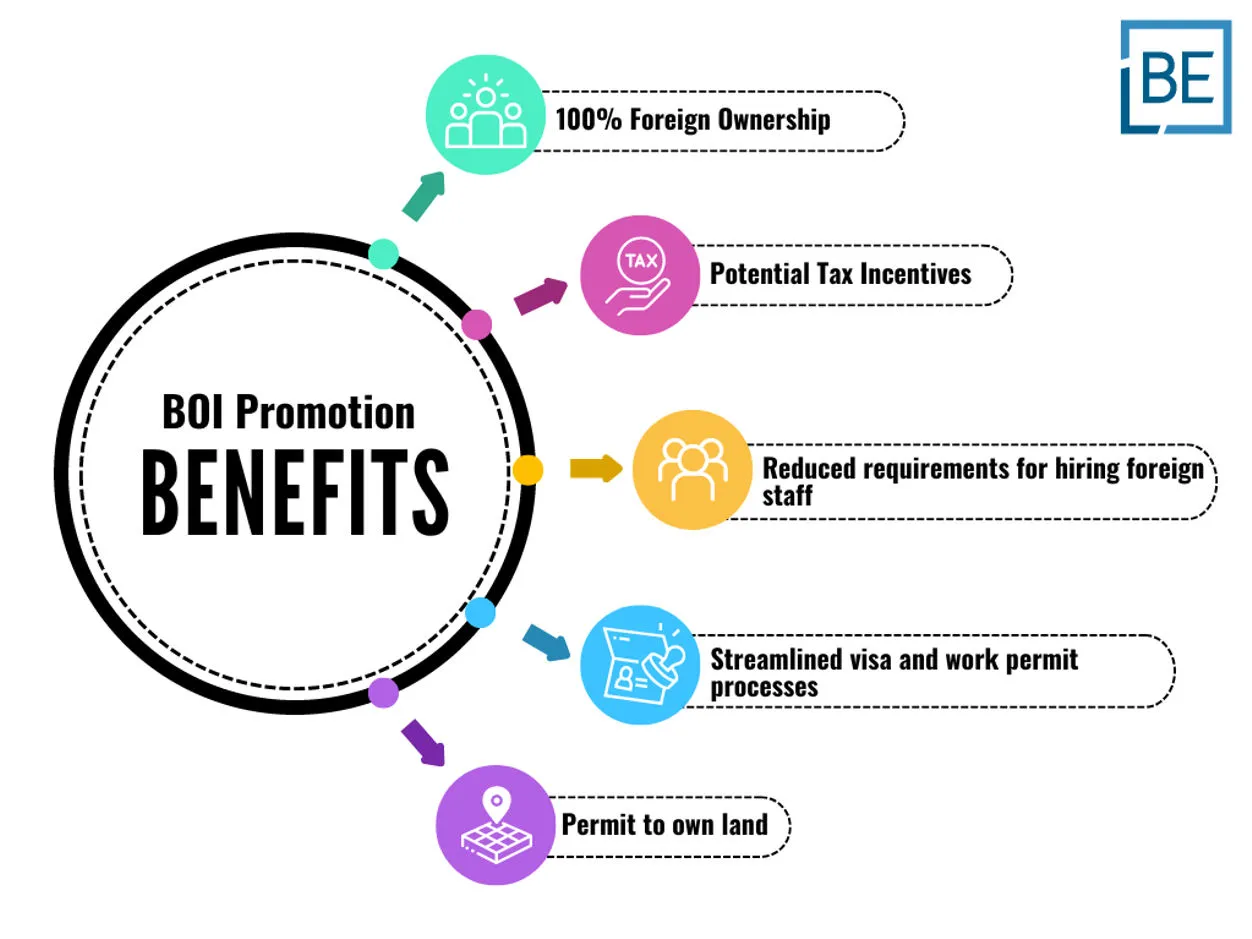

To encourage investment, the BOI provides a comprehensive package of Thailand tax and non-tax benefits. These include 100% foreign ownership, corporate income tax exemptions, import duty reductions, and land ownership privileges for foreign investors. Additionally, the BOI facilitates the process of obtaining work permits for skilled foreign workers and offers support in special economic zones.

Key points

- The Thailand Board of Investment (BOI) offers tax and non-tax incentives to attract foreign investment, including Thailand tax exemptions e.g corporate income tax, import duty reductions, and land ownership privileges.

- BOI-promoted companies can be 100% foreign-owned, bypassing restrictions of the Foreign Business Act that normally limit foreign ownership to 49.99% in certain sectors.

- Foreign employees of BOI-promoted companies benefit from streamlined visa and work permit processes, with no quotas on hiring foreign staff.

- Tax incentives include corporate income tax exemptions for up to 13 years, import duty reductions on machinery and raw materials, and additional tax deductions for infrastructure investments.

- The BOI aims to strengthen Thailand’s economy by focusing on innovation, competitiveness, and sustainable development through these incentives.

Overview of Thailand Board of Investment (BOI)

The BOI is instrumental in promoting both domestic and foreign business investments in Thailand. Its primary objective is to enhance Thailand’s competitiveness and prevent the country from falling into the “middle-income trap” by fostering steady and balanced economic growth.

How Does the BOI Promote Foreign Investment?

The BOI plays a key role in attracting foreign investment to Thailand. It serves as the main public agency for promoting business investment, both domestically and internationally. The organization offers a range of services designed to meet the diverse requirements of investors, including:

- Providing information and support to interested foreign investors

- Offering tax-based and non-tax-based incentives

- Facilitating the investment process

- Assisting Thai investors looking to invest abroad

What Types of Companies Can Qualify for a BOI Promotion?

The BOI’s strategy focuses on three main areas to strengthen Thailand’s economy:

- Innovation: Encouraging the use of technology and new ideas to improve the economy

- Competitiveness: Ensuring businesses can grow and compete effectively

- Sustainable development: Promoting environmentally friendly practices and social responsibility

To achieve these goals, the BOI offers special perks to businesses investing in research, technology, and projects deemed essential for the country’s growth. These incentives include 100% foreign ownership, tax breaks and the ability to hire foreign experts. The BOI aims is to attract companies that can bring in new technologies and ideas, ultimately making Thailand’s economy stronger and more innovative.

Is your business eligible for a BOI promotion in Thailand?

For more information, please see our blog post here. To find out whether your business is eligible for a BOI promotion in Thailand, why not book a consultation with one of our experts. During this consultation we will be able to explain the BOI, how the application works and identify whether your project may be eligible to apply. Consultations can be booked here.

What Incentives Does the BOI Offer Investors in Thailand?

The incentives offered by the BOI are one of the key attractions for investors considering Thailand as a destination for their business ventures. The Board of Investment (BOI) has designed a wide ranging package of incentives to encourage both foreign and domestic investment in priority sectors that align with Thailand’s economic development goals.

These incentives are broadly categorized into two main sections:

- Thailand Tax Incentives

- Non-Tax Incentives

Each category offers distinct benefits aimed at reducing the financial burden on investors and facilitating smoother business operations in Thailand.

Non-Tax Incentives for Investors

The Thailand Board of Investment (BOI) offers a range of non-tax incentives to attract foreign investors and promote economic growth. These incentives include land ownership privileges, visa and work permit benefits, and foreign currency regulations.

100% Foreign Ownership

Depending on the activities a business undertakes, it is likely that foreign ownership of a regular Thai Limited company would be limited to 49.99%. This limitation is due to the Foreign Business Act and the restrictions it places on foreign owned companies from undertaking certain business activities. For more information about this, please take a look at this article.

BOI promoted companies are not subject to these restrictions and generally can be 100% foreign owned (subject to certain exceptions).

Visa and Work Permit Benefits

BOI promoted companies, unlike other company structures, are not subject to any quotas when hiring foreign employees. For example, Thai Limited Companies cannot hire a foreign employee unless the following quotas are satisfied:

A ratio of 4:1 Thai to foreign employees. Essentially, there must be 4 Thai employees employed by the company per 1 foreign employee. The removal of this quota takes away a massive barrier to employing foreign staff and is a huge advantage to a BOI promotion.

Another benefit for BOI-promoted companies is a streamlined visa and work permit processes for foreign employees:

- They are not subject to the same capital and Thai staff requirements as other companies.

- Foreign employees can obtain BOI visas and work permits from the One Stop Service Center, with a faster approval process.

- The application can be completed in a single day, compared to the standard process through Labor or Immigration offices.

For more information about the BOI visa and work permit, please see here.

Land Ownership Privileges

BOI companies can own land, however, the size of the land that can be owned by a BOI promoted company depends on the details of each individual promotion awarded. It is important to note that all BOI companies can own 1 Rai of land for office and residential purposes.

The BOI has specific investment categories that permit land ownership of larger land areas, such as manufacturing, tourism, technology, and certain service sectors. However, in such a situation, the usage of land owned by BOI-promoted companies must align with the activities specified in their investment promotion. The land must be used for the intended business purposes as outlined in their BOI agreement. For example, if a company manufactures, the land can be used to set up production facilities, warehouses, or related infrastructure.

Foreign Currency Regulations

Non-residents and foreign investors benefit from flexible foreign currency regulations:

- There is no limit on bringing foreign currency into Thailand.

- Investors can freely transfer foreign currency for direct or portfolio investments.

- Repatriation of investment funds and repayment of overseas loans are permitted with proper documentation.

However, transactions exceeding 50,000 USD must be reported to an authorized bank using a Foreign Exchange Transaction Form.

Tax Incentives for Investors

The Thailand Board of Investment (BOI) offers a comprehensive package of Thailand tax incentives to attract foreign investment and boost economic growth. These incentives are designed to enhance Thailand’s competitiveness and create a favourable environment for businesses in various sectors.

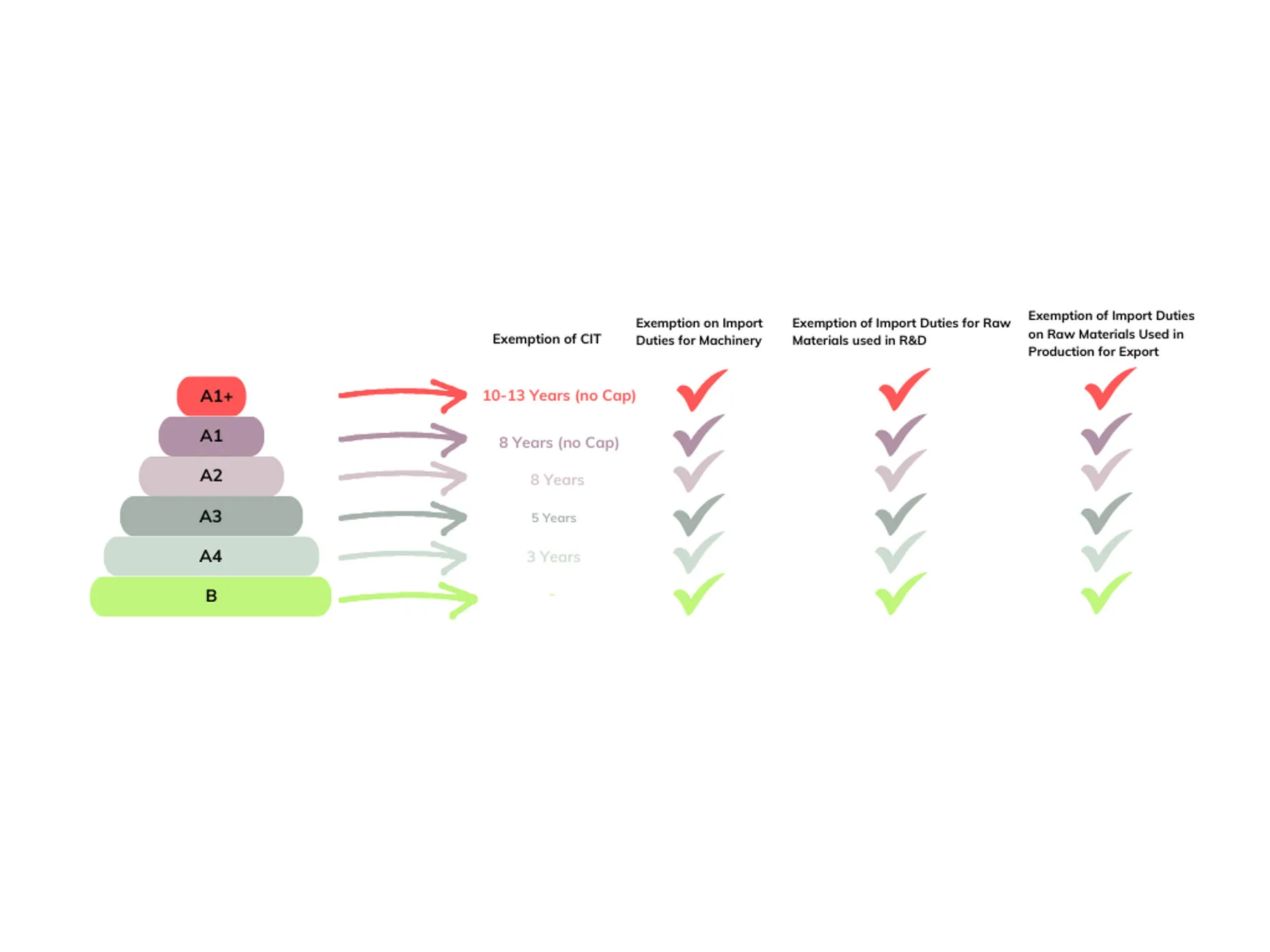

Corporate Income Tax Exemptions

The BOI grants exemptions in corporate income tax for companies for up to 13 years, depending on the nature of the business and its location. Businesses using high technology (Group A) receive the most substantial benefits, with tax exemptions lasting up to 13 years. For businesses located in industrial estates or promoted industrial zones, an additional year of corporate income tax exemption is granted. Companies situated in “Investment Promotion Zones” receive three extra years of corporate tax relief.

Please note, not all BOI promotions are awarded CIT exemptions and the length of the corporate income tax exemption awarded to a BOI promotion depends on the activity of the business and the promotion awarded by the BOI.

Import Duty Reductions

To support manufacturing and research activities, the BOI offers import duty reductions on machinery and raw materials. These include:

- Exemption from import duties on machinery

- Exemption or reduction of import duties on raw and essential materials for manufacturing export products

- Reduction of import duties by up to 90% on raw materials for domestic sale manufacturing

- Exemption from import duties on items used for R&D purposes

Additional Tax Deductions

The BOI provides further Thailand tax incentives to encourage investment in infrastructure and promote decentralization:

- Deduction of 25% of infrastructure installation or construction costs from net profit, in addition to normal depreciation

- Double deduction from taxable income for transportation, electricity, and water supply costs for ten years

- Deduction of up to 70% of the investment amount from net profit for ten years

These tax incentives aim to make Thailand an attractive destination for multinational enterprises and support the country’s economic development goals. These incentives are also designed to encourage investments outside of major urban centers such as Bangkok, promoting economic activities in less developed regions. This is part of a strategic effort to create a more balanced economic landscape across Thailand.

Other Incentives Offered by the BOI

Beyond the basic incentives, the BOI offers merit-based incentives for projects that engage in research and development, training, and technology transfer. Companies can receive additional years of corporate income tax exemption based on their investments in these areas.

Competitiveness Enhancement

Additional incentives may be available for projects that meet specific criteria, aimed at boosting competitiveness in targeted industries.

- Research and Development (R&D): Companies investing in R&D activities can receive merit-based incentives, including additional corporate income tax exemptions. This encourages businesses to innovate and develop new products or services, contributing to overall economic growth.

- Licensing Fees: Incentives are available for companies that incur licensing fees for using domestically developed technology. This support helps businesses leverage local innovations and integrate them into their operations.

- Collaboration with Educational Institutions: Companies are encouraged to collaborate with academic institutions and research organizations. This partnership can lead to funding opportunities and additional tax benefits, promoting a culture of innovation and technology transfer.

- Training Programs: Companies can receive additional deductions for expenses related to training programs that enhance employee skills, particularly in advanced technologies and innovation. This includes training for new technologies, management skills, and operational efficiency.

- Internship Opportunities: The BOI promotes the establishment of internship programs for students in science and technology fields. Companies that engage in these programs can benefit from tax incentives, fostering a skilled workforce that meets industry needs.

Qualifying projects could be eligible for an additional CIT exemption for 1-3 years, depending on the decision of the BOI.

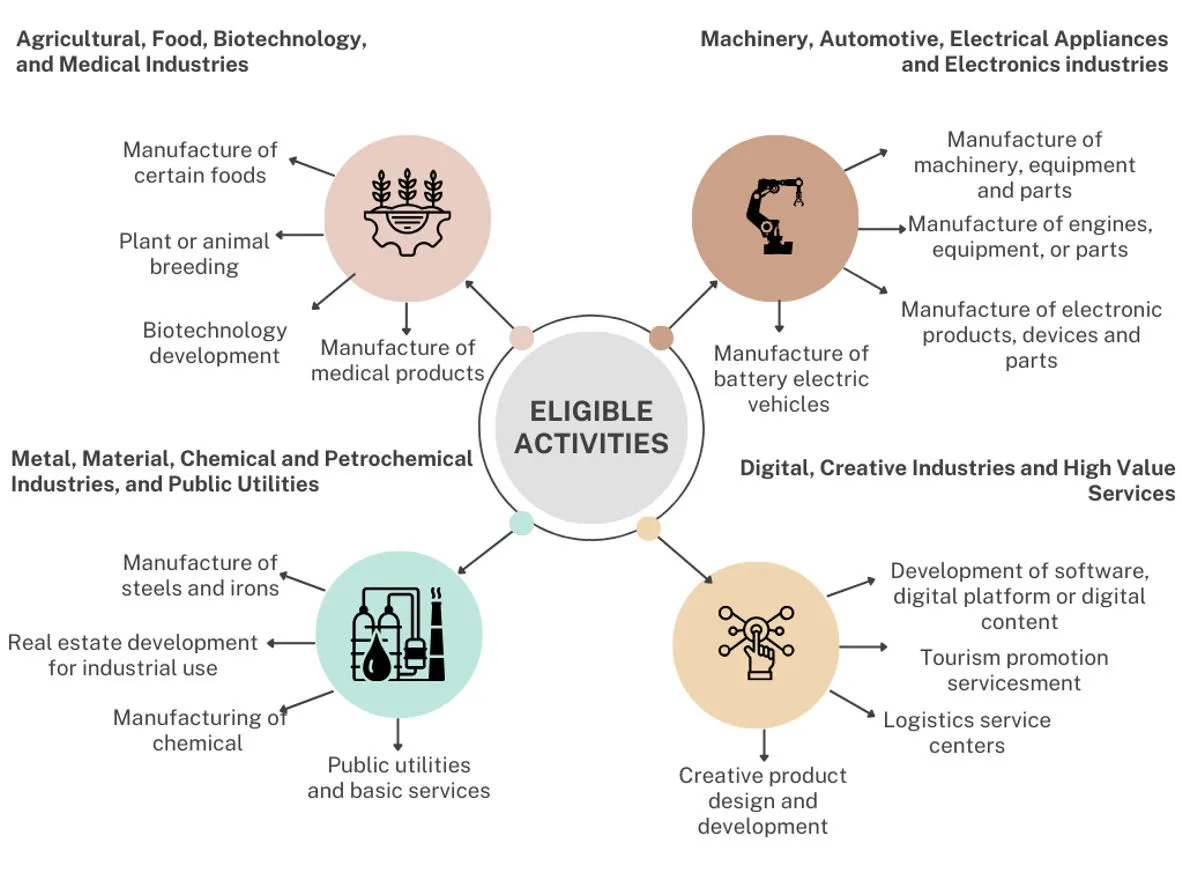

Targeted Core Technologies and Other Targeted Activities

Incentives are available for projects focused on advanced technologies, encouraging innovation and technological advancement.

Eligible Targeted Core Technologies activities include:

- Biotechnology Development

- Nanotechnology Development

- Advanced Material Technology Development

Eligible projects could receive an additional CIT exemption of 2 years (in addition to the basic incentives).

Other Targeted Activities include:

- Electronics Design

- R&D

- Biotechnology

- Engineering design

- Scientific laboratories

- Calibration services

- Vocational training centers

Eligible projects could receive a CIT reduction of 50% for 5 years (in addition to the basic incentives).

Area Based Promotions

The BOI also offers incentives for projects based within BOI promoted industrial estates or industrial zones. Projects located within these areas will be granted an additional one year CIT exemption.

Furthermore, if a BOI promoted project is located within one of the 20 designated areas with low per capita income, are eligible for 3 additional years of CIT exemptions. Please note, projects who have been awarded a promotion under groups A1 or A2 will instead receive a 50% CIT reduction on any net profit earned from the promoted activities for 5 years after the original CIT exemption has expired.

The 20 areas of low per capita income are as follows:

- Kalasin

- Chaiyaphum

- Nakhon Phanom

- Nan

- Bueng Kan

- Buri Ram

- Phattalung

- Phrae

- Maha Sarakham

- Mukdahan

- Mae Hong Son

- Yasothon

- Roi Et

- Si Sa Ket

- Sakhon Nakhon

- So Kaeo

- Surin

- Ning Bua Lamphu

- Ubon Ratchatnai

- Amnatcharoen

How do the Incentives Offered by the BOI Help Foreign Investors?

One of the most significant advantages on offer from the BOI for foreign investors in Thailand is the allowance for 100% foreign ownership of businesses in certain sectors enables investors to maintain complete control over their operations, strategic direction, and management decisions without the need for local partners.

The ability to be 100% foreign owned is an important aspect for the majority of companies, however in Thailand it is not available to every company due to the restrictions of the Foreign Business Act (FBA). The FBA restricts foreigners or foreign owned companies from undertaking over 50 categories of business activities in Thailand.

In relation to these 50 restricted business activities established under the FBA, foreign ownership of a limited company is capped at a maximum of 49.99% (unless an FBL or a BOI promotion has been obtained). If 50% or more of the shares of a company are owned by a foreigner, it is considered a foreign company.

For more information about the Foreign Business Act in Thailand, please see here.

The BOI’s facilitation of work permits and visas for foreign employees also brings significant advantages to investors in Thailand. These advantages include:

-

Access to Global Talent:

Reduced qualifications for obtaining work permits allow companies to attract skilled professionals from around the world. This access to a diverse talent pool can enhance innovation and operational efficiency, as businesses can hire experts with specialized skills that may not be readily available in the local market.

-

Begin Work Faster:

The simplified process for securing visas and work permits helps companies quickly onboard foreign talent into their operations.

-

Enhanced Competitiveness:

By employing top-tier international talent, companies can improve their competitiveness, leading to better products, services, and overall business performance.

How can Belaws help?

For more information about the BOI in Thailand, why not talk to one of our experts now?

Please note that this article is for information purposes only and does not constitute legal advice.

Our consultations last for a period of up to 1 hour and are conducted by expert Lawyers who are fluent in English, French and Thai.

Consultations can be hosted via WhatsApp or Video Conferencing software for your convenience. A consultation with one of our legal experts is undoubtedly the best way to get all the information you need and answer any questions you may have about your new business or project.

USD 150

Up to 1 hour

Online payment (Paypal or Credit card)

Legal consultation can be conducted in English, French or Thai

Legal consultations are handled by experienced lawyers from the relevant fields of practice

Frequently asked questions

What is the main goal of the BOI’s tax incentives?

The main goal of the BOI’s tax incentives is to attract foreign investment to Thailand by offering financial benefits to businesses that meet specific criteria. These incentives aim to stimulate economic growth, create jobs, and promote technological advancements.

How long can corporate income tax exemptions last for a BOI-promoted company?

The duration of corporate income tax exemptions varies depending on the type of business and its location. However, it can extend up to 13 years for businesses in high-tech industries and those located in designated investment zones.

What are the benefits of import duty reductions for BOI-promoted companies?

Import duty reductions on machinery and raw materials can significantly reduce the operational costs of BOI-promoted companies. This makes Thailand a more attractive investment destination for manufacturing and export-oriented businesses.

Can all foreign companies in Thailand benefit from the BOI’s tax incentives?

No, only companies that meet the BOI’s criteria and obtain promotion status can enjoy the tax incentives. The BOI focuses on industries and projects that align with Thailand’s economic development goals.

Are there any specific industries that receive more favorable tax incentives from the BOI?

Yes, the BOI prioritizes industries such as technology, research and development, and environmentally friendly businesses. These sectors often receive more generous tax incentives to encourage innovation and sustainable development.

How do land ownership privileges benefit foreign investors?

Land ownership privileges granted to BOI-promoted companies can facilitate business operations, especially for those requiring specific land use, such as manufacturing facilities or research centers.

What are the advantages of streamlined visa and work permit processes for BOI-promoted companies?

Streamlined visa and work permit processes allow BOI-promoted companies to hire foreign talent more efficiently. This helps businesses access specialized skills and expertise, enhancing their competitiveness.

Are there any additional incentives available for companies that engage in research and development (R&D)?

Yes, the BOI offers merit-based incentives for companies investing in R&D activities. This includes additional corporate income tax exemptions and support for technology transfer.

Related articles

Subscribe today

Subscribe today

To our newsletter for all the latest legal news

in South East Asia, Belaws updates and

special promotions on our services.

To our newsletter today for all the latest legal news in South East Asia,

Belaws updates and special promotions on our services.